The Federal Trade Commission (FTC) is challenging private equity-backed efforts that allegedly suppress competition in anesthesiology practices.

A recent case involving U.S. Anesthesia Partners (USAP) claims that private equity firms created monopolistic conditions, driving up prices and reducing quality care for patients.

This marks a critical step in addressing how private equity impacts healthcare.

The Allegations Against USAP

The FTC accuses USAP and private equity firm Welsh, Carson, Anderson & Stowe of buying out competitors to create a monopoly in anesthesiology services.

The result? Higher prices for hospitals and patients and fewer choices for care.

The FTC asserts that such practices violate antitrust laws, which exist to protect consumers from inflated prices and limited access to services.

How This Affects Patients and Providers

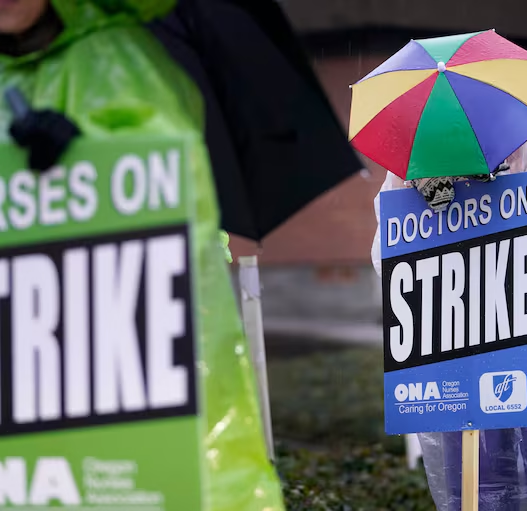

The lack of competition in anesthesiology services can have far-reaching consequences.

With higher prices and fewer options, hospitals may struggle to manage costs, ultimately affecting patients’ bills.

For providers, monopolies can limit their ability to negotiate fair contracts, forcing many to work under less favorable terms.

Why This Matters in Healthcare

Private equity’s involvement in healthcare has long raised questions about prioritizing profits over patient care.

This case could set a precedent for how the FTC and regulators address these concerns.

If successful, it may lead to stronger regulations that ensure fair competition and prioritize patient outcomes over financial gain.

What Happens Next?

The FTC’s case is a crucial moment for healthcare and antitrust enforcement.

Patients, providers, and policymakers will be watching closely as the case unfolds, with the hope that it leads to greater accountability in healthcare systems influenced by private equity.