Accessing mental health care is already a challenge for many Americans, but for those who have insurance, it should be easier, right?

Unfortunately, a common issue known as “ghost networks” is making it difficult for patients to find the care they need.

In a recent article from NPR, the concept of ghost networks is explored, showing how insurance companies list mental health providers in their directories who either aren’t taking new patients, are no longer in-network, or aren’t even practicing anymore.

What Are Ghost Networks?

Ghost networks refer to the directories of providers that insurance companies provide to patients.

On paper, these networks seem extensive, but when patients try to contact providers for mental health services, they often run into roadblocks.

Many listed providers are unavailable, no longer working with the insurer, or not accepting new patients. This leaves patients frustrated and without the care they need.

A study highlighted in the NPR article found that a staggering more than half of providers listed in mental health insurance directories were unavailable to take new patients.

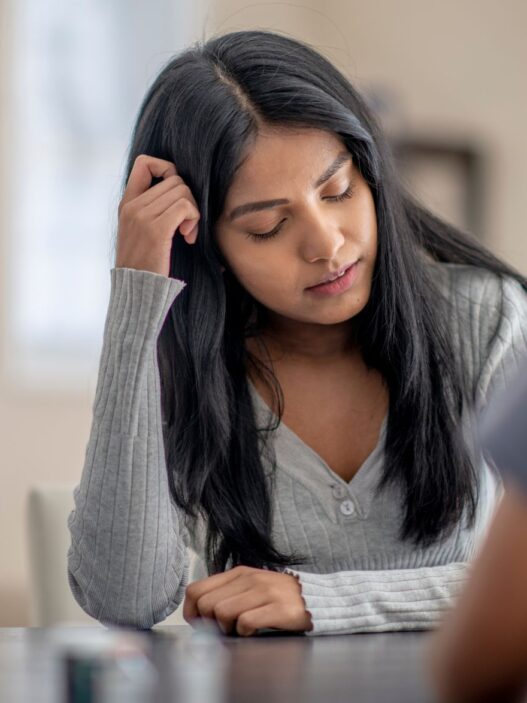

For patients struggling with mental health issues like depression or anxiety, this can be a devastating experience.

The Impact on Patients

When people finally gather the courage to seek help for mental health conditions, the last thing they need is to be met with a long list of dead ends.

The emotional toll of calling provider after provider, only to be told that they’re unavailable, can make people give up on seeking care altogether.

The American Psychological Association (APA) has noted that mental health ghost networks create a significant barrier to care, worsening the mental health crisis in the U.S.

According to a 2021 report by the Commonwealth Fund, mental health access in the U.S. lags behind many other high-income nations, and ghost networks only compound the issue.

Why Do Ghost Networks Exist?

There are several reasons why ghost networks persist. First, insurers are required to maintain directories of in-network providers, but these lists are rarely updated.

Providers may leave the network, move to new locations, or stop taking new patients, but insurers often fail to keep their information up to date.

Additionally, mental health professionals are often overloaded with cases due to high demand and not enough providers.

This means that many therapists and psychiatrists are fully booked and unable to take on new patients, despite being listed in the insurance network.

What Can Be Done?

Fixing the problem of ghost networks requires action from both insurance companies and regulators. Some possible solutions include:

- Regularly updating directories: Insurers should be required to keep their provider directories updated regularly, ensuring that only available providers are listed.

- Stronger enforcement: State and federal agencies should implement stronger penalties for insurers that fail to maintain accurate provider networks.

- Increase mental health funding: Investing in mental health infrastructure, including training and hiring more mental health professionals, can help address the shortages that contribute to ghost networks.

- Transparency for patients: Insurance companies should offer more transparency, making it clear which providers are available and which are at capacity, so patients can better navigate the system.

Mental health ghost networks are a significant hurdle for patients seeking care. These incomplete and outdated provider directories create unnecessary barriers and contribute to the growing mental health crisis in the U.S. Insurers, regulators, and policymakers must work together to fix these issues, ensuring that patients can access the care they need when they need it most.